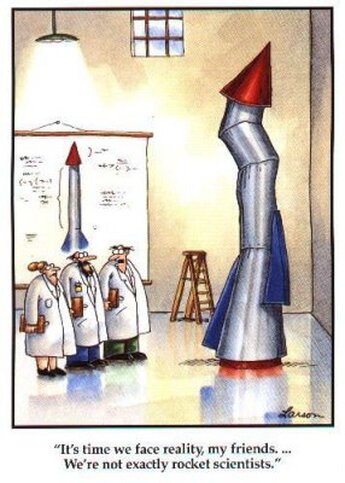

My institution is going through an academic portfolio review that keeps being championed as a best practice, when there is almost no empirical data that I can find that academic portfolio review is a best practice (see a different blog), especially completely ignoring detailed academic program reviews that are. The idea, I guess, is to align academic offerings to programs students want, or at least we think they want, and sell credit hours as efficiently as possible. I think the Far side cartoon at the right is an appropriate metaphor for rubrics that were used. I am in the mood for bad metaphors. So, I wrote this blog. Feedback is always welcome. Stupid Metaphor 1: a bad fast food restaurant decides to only sell water from a hose Imagine a regional/local fast-food restaurant that determines they need to redo their menu to compete for a dwindling supply of customers. They examine data on demand and net-revenue associated with all of the menu items from French fries, vs. Diet Coke, vs 1/2 lb hamburgers, and tasteless grilled chicken sandwiches on a wet soggy bun. The CEO chose not to worry about their competitors, He said, "why give a hoot about Burger King? (side note- I agree with this one-.. I don't give a hoot about Burger King either, and that guy with the crown on TV is just plain scary and weird), McDonalds or Wendy's-what the heck could our business possibly ever learn from them? Especially when they attract 99% of the customers." The CEO had Homer Simpson, his finance guy with an Assistant's degree from the Wart Off School of Business and conservative commentator at his dinner table, build a data based model. Homer went to Dunkin Donuts for a donut and large Coke, and developed the model and the data on the back of a napkin using ketchup to sketch out the polynomial he was sure would impress someone. The CEO looked at the napkin-- wiped ketchup on his tie. And then. proclaimed, "wow! look at this. we have a huge demand for liquid products and make a butt load of net revenue on them, so who needs all these silly solid products like 1/2 lb. burgers that sell much less quickly. We wouldn't need all those stupid employees on the line to cook and wrap them in paper or cardboard boxes,. And, I could take home 25% more salary without a need for that overly expensive 1,000,000 gallons of oil and electricity for hot fryer. And, you know ,that freezer is really a waste of money too. It was bummer that Bubba got locked in there and we had to pay a guy with a blowtorch and a hand grenade to open it up. The smell of rotting food mad my stomach turn. Bubba looked even worse when he was frozen, too. Then there is all the money we lose on toilet paper -wiping up all that shit is hurting my profit, too. Oh.. yeah. by the way, I was also thinking about sugar. It is a bad investment for our customers to want sugar, sugar substitutes, or any of our other products. Dying younger from diabetes doesn't help us in the long run and we need a new business model anyway. So, stay with me now-- I have a new plan.. Let's get rid of it all. The burgers, fries and those terrible apple pies, the ridiculously expensive freezer, the gallons of oil, line cooks and cleaning folk, and just sell water. Not water in a paper cup or in a bottle, mind you. We'll just attach a hose to the gas station next store and charge a few bucks to fill a mug, or to let our customer take a sip directly from the hose for a bit less. We make ridiculous net revenue on water, we won't need all of those surly employees who want me to pay attention and pay them better, and it is exactly what people should want to remain healthy. And, we can get the hose at Dollar General across the street. Genius! ." Homer smiled and had the other donut he brought back to the office in the ketchup soaked napkin,. He liked ketchup on his donut and thought it would go well with water out of the hose. I won't share the end of the story but Homer started a consulting business to help universities focus on water and he never got around to telling me the rest. The ketchup-iced donut idea, however, did not become a hit. As long as a conclusion is driven quantitatively, it allows for great decision making? Back to the academic portfolio process. It truly pains me to go back there, The process is based on, what I think are not very well thought out, error-filled, metrics, with no quality comparisons vs peers, and with several metrics dependent on each other, but counted in the model as independent variables. We are supposed to smart in universities, aren't we? Or is this our leadership, "Hey, it's data. Hey, it's math. It's quantitative, so who needs to hurt our brains thinking about independent or dependent variables and bad data. I mean we have bad data for every unit so it's fair. And, not having to think too much allows us time. Wanna go play around of golf at the country club?." I don't know why there is this idea that if you create bad quantitative models they will support purely objective decision making. I give my university a pat on the back as they did recognize that maybe quantitative metrics weren't perfect. So, programs that didn't do so well in the objective data model, got their day in court with a 1,000 word context statement. These were reviewed by faculty committees that had no time to seriously evaluate them. But, at least every program is on an even playing field, even if it is one made of quick sand. Believe it or not, departments and programs were not allowed to submit recent self studies, that took months to prepare with their extensive external reviews. Stupid metaphor 2: Airlines are good metaphors for universities In creating the case for the urgency of change, the administration often relies on the concept that large for-profit businesses are good metaphors for universities. And, the general assumption underlying the change, which is somewhat politically driven, is that student demand should be directly correlated to financial ROI of their investment in a college education. Thus, university investment should be made in programs where the short term ROI (e.g, first job after graduation) is highest, or where workforce needs are greatest, because that it is what will attract students from going to other universities in the state. We haven't empirically tested that hypothesis. If I were a betting man, though, I would not bet on that strategy based on my conversations with students regarding why they come to this university and why they stay. (They can get those programs at institutions across the state) But, I am at best an average bettor. Are universities akin to for-profit businesses? To me the answer is both "yes" and "no." They are definitely like for-profit and non-profit businesses in the sense that expenses cannot exceed revenues (plus reserves) and a university survive for very long. But, universities are mission driven non-profit organizations whose focus is the mission, not profit. So, in my opinion they are much more like The Nature Conservancy than they are like American Airlines. I have not heard a single administrator here use a metaphor like the Nature Conservancy to discuss "business" challenges. Our CFO indicated to me when I was provost that he and other university CFOs thought that universities are budgetarily like airlines, and are going under because those damn air traffic controllers (faculty in the case of universities) don't bring any revenue and whine all the time. The UNCG CFO wrote this in an email to me and the chancellor during COVID when airlines laid off thousands of pilots and crew members, so I think the idea was that universities should grow and shrink with short term enrollment changes. The email was sent on August 25th, 2020 with an article documenting huge workforce cuts in airlines. Here is what it said. (sent to chancellor copied to me) "I think you've heard me refer to my work at NACUBO and the similarities between the pricing model and capacity issues that higher ed and airlines share. Business types see the similarities immediately. Higher ed types always argue with me, that higher ed isn't a business... Thought you might find this interesting. American and United have now announced furloughs/layoffs for 1/3 of their respective workforce." There are many reasons I disagreed with the airline metaphor. Here are some. First, students are on a 4-6 year trip that requires a bit more stability than travelers surviving a couple of hours in coach. I suppose that throwing the pilot and crew out the emergency exit mid-air on a four year flight, when flight operations mentioned low holiday ticket sales makes sense? Second, universities have no control on their pricing- for example we can't double the cost of tuition in courses with high demand and lower the prices in courses with less demand. We can't sell expensive first class programs to wealthy people at 5 times the price- they go to High Point University. And, although we can charge fees for all sorts of things like airlines do, we cannot use money generated from fees as general operating revenue- those funds can only be used for their designated purpose like having student fees pay 87% of the athletics budget. We also don't have much control on what fees we can charge and how much we can charge. Who builds and flies the academic airplane? Finally, pilots and flight crew don't directly generate revenue, though airlines can't generate any revenue without pilots. In universities, faculty (which are viewed as pilots/flight crew in the airline metaphor) generate the majority of operating revenues through credit hour production (even though the cost-revenue model the administration developed for our process assigned 38% of the revenue to cost centers because that is where the revenue brought in my faculty teaching is spent. Brilliant!). More importantly faculty are the only employees that can propose and deliver program changes, as well as new programs that can generate more net-revenue. They are not just employees who teach classes that generate operating revenues(e.g. metaphorically pilots and crews). They actually build a big part of the academic plane and determine many of the routes. Continuing on with the bad metaphor On one hand, students pay for credit hours in the same way that a traveler pays for an airline ticket, and metaphorically they are both trying to get from point A to point B, too. But students are not customers like airline travelers. They aren't paying for someone to take them from point A to B. Rather, I think of students and parents as investors in a student's future. So, I think that the "business" metaphor should view students as investors in the mission like shareholders in a public company, not as customers. OK.. you are right-- students are too busy to ask for quarterly financial statements, even though they should. Viewing them as investors (as opposed to how the were labeled in a published table as "student customers" coming to our take-out window to buy some cheap credit hours) would better align with the not-for-profit mission of a university campus. It would also significantly change the question from "how do we attract students to buy efficiently taught credit hours?" to "how do we make ourselves the most attractive place for students to invest their futures with us, within our financial limitations?" Stupid metaphor 3: Private Equity Back to a university being a "business." If I am remembering - I think private equity firms love coming to floundering businesses, cutting costs and selling off the parts. They don't always talk much about revenue, at least in in rpk's "private equity" report to the Kansas Board of Regents. It seems, perhaps, that it might be a wee bit of an oversite to not have a discussion with faculty on our campus regarding how to develop and implement program changes or new programs that attract students and generate more net revenue. Everything being told to us in our more than 80 engagement parties hosted by our leaders is about cutting and/or reinvesting (without much clarity on what the means or looks like). I am all for reallocating but I always thought strategy, tactics and mission should be aligned. When I was provost at the University of Arkansas, we incentivized the development of net-revenue generating programs, that attract new students [don't simply move them around the university] by tuition sharing with departments that created professional masters program. Those programs support a different group of potential students, and they can succeed often by using existing unused capacity in classes. That led to the development of several programs that filled in their first year and buffered the university's enrollment loss during COVID, and allowed those programs to grow as demand grew- including hiring more faculty to deliver the growing programs. It is much easier though, at least over the last two years where I work to view faculty as interchangeable commodities , as opposed to the group of employees whose ingenuity might actually attract students and generate increased net-revenue. Cutting is just so, so much easier as way to make revenues and expenses work. It might just be best to sell water. from a Dollar General hose. We'd only need a few high paid administrators, one hose, someone to turn the hose on and off, and we would get a windfall of net revenue. In numerous forums and discussions I have heard something like "any business would do x" in justifying new resource allocation decisions. Having worked as a senior administrator in a soft-money research institution and in universities all of my life, I have found that mission driven organizations tend to have a different and more limited range for "x" to make cash flow work, e.g., The Nature Conservancy would probably not buy or create a plasma donation non-profit in the middle of a protect conservation area, or a Starbuck's franchise, to make revenues and expenses work. Nor do I think non-profit conservation land trusts make their protected lands a source of new net-revenue by turning those lands into tourist destinations. And none of them charge their investors for a basketball team. Homer Simpson's consulting firm told me that Amazon would sell even sell my blog articles if it made them money. That is really hard to believe. Back to portfolio review I also mentioned in my first paragraph that the assumption inherent in the campus process is that, if we invest in programs where students will get the highest financial ROI, students, then they will come. Their coming here will allow us to meet our mission of a strong "R2" with a transformational, social mobility, mission, founded in the culture of a wide ranging education.. One challenge with this assumption, is, well, it's wrong. I am not sure if there is any empirical evidence that such an assumption works to predict where demand will be. Though, I have to admit is really a great narrative to tell oneself in the mirror to or to deaf person on a park bench Maybe we should ask the CFO at Emporia State how it is going. Or, ask how our esports program is doing with respect to student enrollment. To be somewhat fair (but the joy of blogs is throwing fairness and editors out the window), the university is using empirical data on current program demand vs capacity. I have to admit that I am a huge fan of empiricism. In this case, the university's demand data suggest that our investment should be in programs like nursing, music performance, or graduate programs like genetic counseling where we have more applicants than we can accept. That is where our students want to be! True! But guess what- the university gets poorer for every additional student we teach in those programs (they are really expensive to teach). And, it might be hard to grow nursing too much unless we want to build a hospital solely for clinical placements for nursing students. (Homer shook his head and whispered I don't know what I am talking about. He might be right.) Ok.. universities are truly a mission-driven non-profit business. I don't deny the value of making sure all of the employees in a university understand that they are part of a non-profit "business" where there needs to at least be enough revenue to run the institution. And, that there is transparency (there isn't enough transparency here) on revenues and expenses. But, the metaphor needs to include the difference between mission-driven non-profits and for-profit businesses. And, let's not forget that for-profit universities have generally not been successful, at least for very long, other than in being a large basin for federal financial aid, and certainly have not disrupted the mission-driven non-profit higher education sector. And, yes, I am a curmudgeon On a final note, I think it is terrible that higher education funding and purpose has become a political football in boards and state legislatures. I also think it is terrible that administrative salaries have increased far faster than faculty and staff salaries. One reason this disturbs me is it is wrong- since talent at the faculty level is close to as important as talent at many administrative levels. More importantly to me is that it causes faculty administrators to become addicted to their salary. warping decision making because of fear of losing 60% (in my case) of one's salary by going back to faculty, if they don't go along with ideas they think are wrong-headed. I also despise the reality that there is a tendency for administrators (including me when I was one) to try and solve problems by hiring more administrators. Many times those additional administrators become a larger and larger audience to to applaud the narrative that faculty are lazy, obstructionist, whiny, luddite miscreants out to destroy the country along with Joe Biden. I am also depressed that public higher education, especially in elite schools, has become the enforcer of socio-economic inequality, not the great equalizer it was intended to be. So, I guess I am generally unhappy where everything educationally related is going locally and nationally Oh.. don't universities need to change? First, everyone should remember that the public trust of higher education has been questioned since at least the 1960s. Second, I cannot argue that regional public universities have a problem. In most states, the capacity for in-person, 4-year degrees is likely to exceed the demand in the foreseeable future. So, something probably has to give. The question is what has to give. The current strategy is betting that if we align programs with workforce needs and predicted student demand that we will somehow outcompete the other institutions in the UNC system. I just don't see it working. The chancellor indicated in a recent graduate forum that other UNC universities are going to do the same kind of academic portfolio review. If so, all of the campuses in the UNC system will all end up trying to offer the same net-revenue generating programs (those with high workforce demand) with high positive revenue margins. The current discussion is all about the APR leading the institution into a more competitive state- that was recently written in a letter to suggest the APR process will lead to sustainability of the university 20 years out. Yet, the some of the rubrics are based on a student cohort that started in 2018 and went through COVID, and on admissions and research data during that time. I am not sure that differences in student graduation rates in the 2018 says anything about the future. The metrics also don't include any measures of the quality of programs (other than whether students apply) that often come through comparison against peers and through academic program review. And, neither the chancellor or the provost seem to be able to articulate a vision for post-APR, other than that we will reinvest resources into stronger programs. The mantra is that the status quo needs to die and we have to change. I don't disagree with needing to change, but the change has to support a vision for the future with tactics aligned to that vision, and to make us competitive in our competitive context. Nothing of the sort has been communicated by university leadership. And, there really was never an attempt to rally faculty to use their intelligence and creativity to help solve the future challenge of competitiveness in a changing demographic, so a lot of that energy is now just being used to fight a terrible process. The chancellor has enormous responsibility and authority for ensuring the success of the university. The Chancellor also is charged with articulating a vision of the university that excites internal and external stakeholders. And, in most universities, deans are responsible for aligning a disciplinary (school or college perspective) vision with the larger one. Undoubtedly, not everyone will be happy with the tactics to realize that vision locally or at the university level. , But, it is really hard for many students, faculty staff and some external stakeholders, to get behind seemingly destructive change, that is not tied to a vision for how UNCG competes and will be better in the future. But, I am a happy curmudgeon Despite all of this, I am still very grateful for having a life focused on helping propel students into meaningful and successful lives (they get to determine what successful means). I care deeply about UNCG. I loved the vision that the chancellor articulated when I was hired as provost- to be a great "R2." To me that had a very specific meaning. The university would build a select number of research areas/PhD programs that are nationally competitive, but would retain its focus on transforming the lives of students whose lives might not have otherwise been transformed. That vision seems to be gone- at least it is not aligned with the APR. I think implementing tactics toward that vision would require change, could make UNCG distinctive in North Carolina, and perhaps would solve the competitive enrollment problem.

0 Comments

Leave a Reply. |

|